Changes in the amount of the childcare allowance from 1 July

As of 1 July 2021, the amount of the childcare allowance (CSED) has increased from 70% to 100% of the gross salary, on which only personal income tax is payable, no social security contributions. As a result of this favorable amendment, mothers receive a significantly higher remuneration than before for the first period of childcare (168 days).

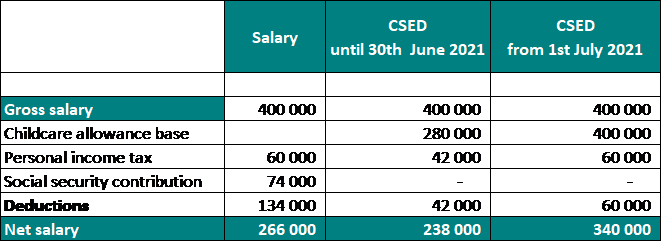

The following table illustrates with a practical example, how much the CSED of an employee with a gross salary of HUF 400,000 will increase after the change.

The table shows that the gross salary of HUF 400,000 without any allowances (e.g.: family, personal) and after all deductions the employee receives a net amount of HUF 266,000. According to the previous rules, the monthly CSED amount after this amount was HUF 238,000; according to the new rules, the net value of this benefit has increased to HUF 340,000 from 1 July.

It was also possible before that due to special rules for CSED calculation, if the employee received a bonus payment during the CSED calculation period, the monthly net amount of CSED was higher than the previous net salary, but with the new rules, the net amount of CSED will be higher than the previous net salary for everyone. The difference is the amount of social security contributions that will be deducted from the normal salary, but not from the CSED amount.

The rule change will also affect those who gave birth earlier but are still entitled to CSED after 1st July 2021.

***

If you have any further questions on the payroll cases, please contact our payroll specialists.

This newsletter provides general information and does not constitute tax advice.