Other taxes

1. Company car tax

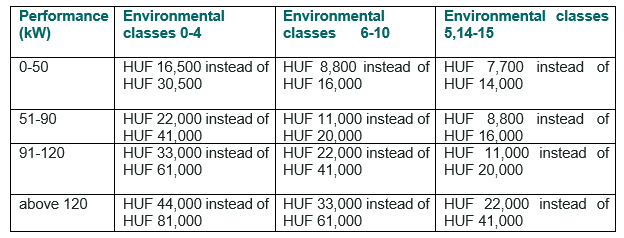

Perhaps the change that will affect the widest range of businesses is that company car tax will be almost doubled for the period between 1 July 2022 and 31 December 2022 for all performance and environmental categories.

The applicable lump-sum tax amounts are presented in the following table:

2. Public charges on simplified employment scheme of film statisticians, seasonal and casual workers

The special tax rate for the simplified employment of film statisticians will be 3% of the minimum wage per employee for each calendar day of employment, instead of the current HUF 4,000.

The employer's contribution for seasonal agricultural and tourism work will increase from HUF 500 per day to 0.5% of the minimum wage for each calendar day of employment. For casual work, the tax rate will increase to 1% of the minimum wage from the current HUF 1,000 HUF per day.

Further changes:

- the maximum net daily wage payable to a film statistician will also increase from the current HUF 18,000 to 12% of the minimum wage;

- the basis for calculating the pensions of seasonal workers, casual workers and statisticians will increase as well.

The new tax rates will apply for the first time to the simplified employment relationships entered into in July, 2022.

The tax rates, the maximum net salary payable to statisticians and the pension bases will also be available on the Hungarian tax authority's website.

3. Public health product tax

As of 1 July 2022, the range of products subject to the public health product tax will change significantly (e.g. syrups and certain snack products will also become taxable). In many cases, the tax burden will increase (e.g. soft drinks with added sugar, energy drinks, salted snacks, flavoured beer, etc.).

However, in the future, alcohol products will be out of the scope of the public health product tax.

4. Excise duty

From 1 July 2022, excise duty on spirits and tobacco products, as well as LPG, natural gas, fuel oil, electricity and some other goods will increase.

June 9, 2022

***

Should you have any questions regarding this newsletter, the tax experts of VGD Hungary will be pleased to assist you.

This newsletter provides general information and does not constitute tax advice.